The older we get the more we realize that the one class we never had at school was probably the one we needed the most, Financial Literacy 101. Interest rates and returns on investments can be difficult to understand when all we really want is to be able to just spend money now or have some stashed for the future. The COVID-19 pandemic was an eye opener regarding cash flow, financial stability and security. If anything we now know that having access to an emergency fund is not only smart, but could also be a life-saver.

The old fashioned way of just depositing money in the bank and pretending you don’t know it exists just doesn’t cut it anymore. Because of inflation, by not actively growing your savings you are really just losing money. If you are like us and financials aren’t your strong suit, trying to invest on your own is challenging. We have no idea what bonds, stocks and dividends mean or how to purchase them and even if we did, what to do next.

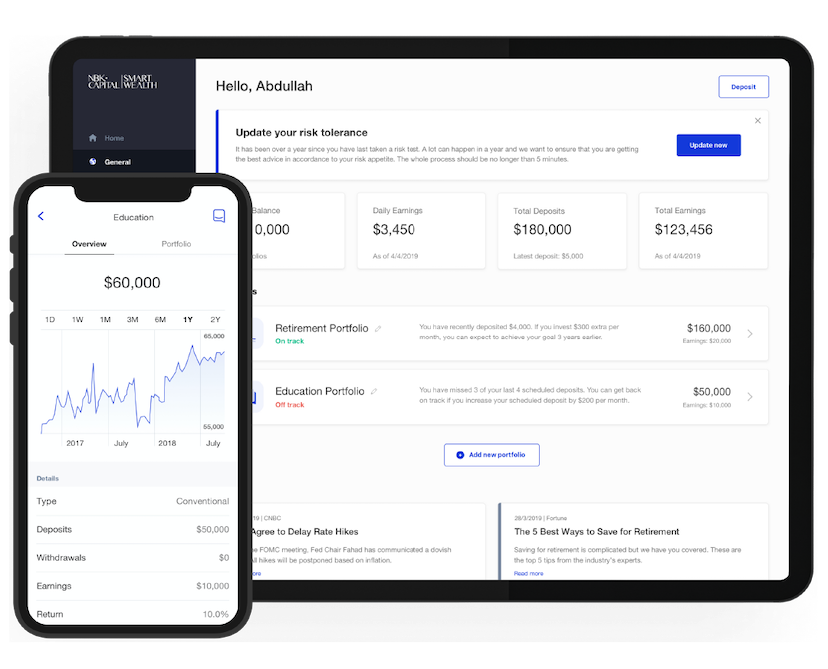

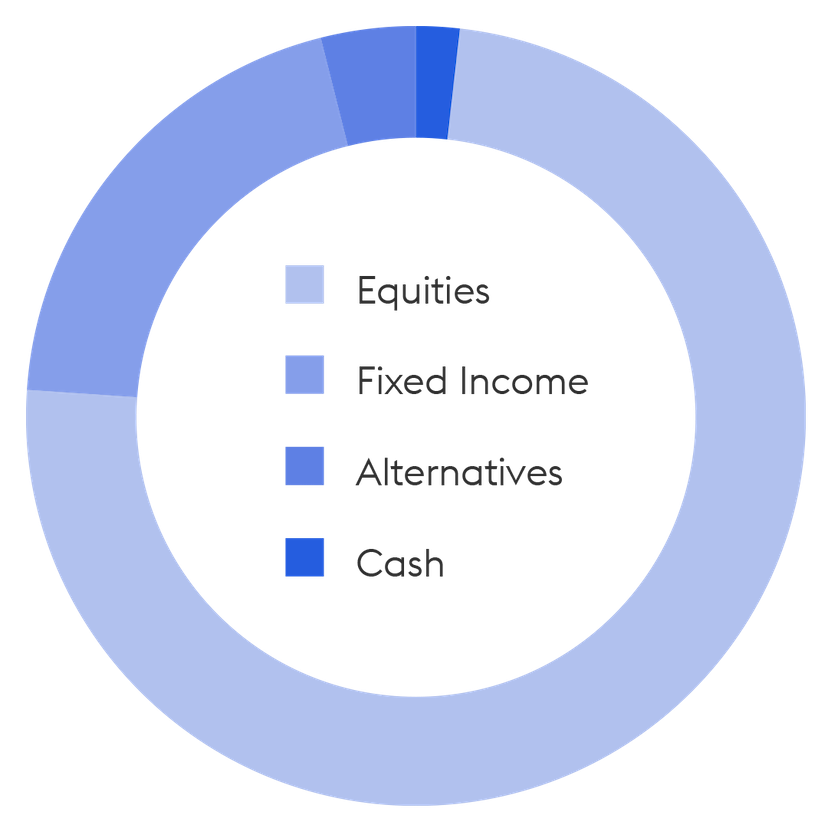

NBK Capital, have come up with a new financial advisory and investment service called Smartwealth. It is an easy way to invest, save and plan for a better financial future. The service gives you access to international financial markets by providing you with a globally diversified investment portfolio with different asset classes based on your financial goals and aspirations.

For us regular folks that just means that their team of experts tailor an investment plan suited to your financial goals. They ask you what your goals are, how much money you want to start with and they handle the rest. It is stress-free, simple and much less risky than other options, so you can just focus on the important things in life, like where to vacation with your new-found wealth.

Because every person’s goals are unique and tend to shift with age and life circumstances, so should your investment plan and portfolio. SmartWealth takes all of that into account and the team there will check in with you to let you know how things are going and you can always update them with new directions if your needs have shifted. In your 20s and 30s you might be focused on travel, education and finding ways to advance in your career while later you might want to focus on growing your retirement fund. So it is only natural that your investment can mirror the stage you are in.

You can manage and monitor your investments through the website or mobile application, and easily make deposits or redeem your earnings at any time and wherever you may be. You’ll have access to investment professionals right at your fingertips to help you with your needs. As well as active and daily reporting through all your smart devices.

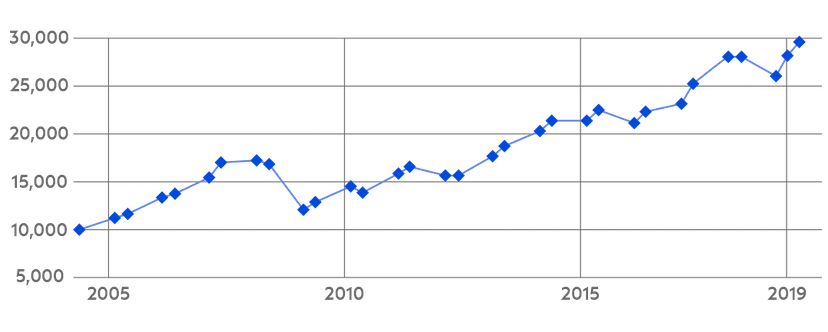

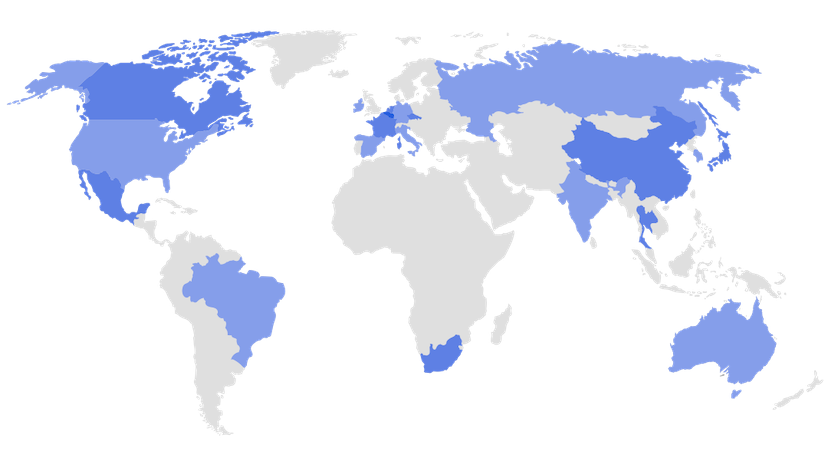

Because SmartWealth portfolios give you access to global financial markets and top tier international companies it is easier to weather local economic downturns. This also helps keep your portfolio diversified. It is normal for industries to experience highs and lows, but if you invest your money in different things it makes it less likely that you experience an overall drop. This coupled with the long-term strategy reduces risks.

Adulting is hard, but investment doesn’t have to be thanks to SmartWealth.

For more about SmartWealth visit nbkcapitalsmartwealth.com and follow @nbkc.smartwealth on Instagram. Images courtesy of www.nbkcapitalsmartwealth.com.